Investment Advisory in Spain

Investment Advisory in Spain for Foreigners and Non-Residents

At LPB Solicitors, we offer high-level legal and tax advice for foreign investors and non-residents seeking secure, high-yield investment opportunities in Spain. Our team of legal consultants, English-speaking lawyers, and immigration lawyers provides personalized support in structuring, protecting, and optimizing your investments.

We specialize in sourcing high-return real estate assets from off-market channels, including distressed properties, bank portfolios, and investment funds, offering access to unique opportunities not available on conventional real estate portals. Our legal expertise ensures that every transaction is safe, tax-efficient, and compliant with Spanish regulations.

Leave your details to receive 10 high-yield, off-market investment opportunities not available on public portals

What Sets Us Apart

Access to Hidden Deals

Legal Advice for Investors

English-Speaking Legal Consultants

Why Foreign Investors Need Strategic Advice in Spain

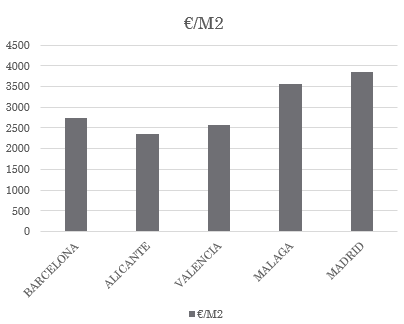

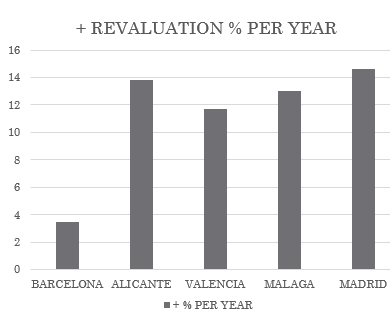

Spain’s Real Estate Market Shows Strong and Sustained Growth

The Spanish real estate market has experienced steady growth over recent decades, particularly in high-demand cities such as Barcelona, Madrid, Valencia, Alicante, and Málaga. Limited new construction, combined with rising rental prices, is driving a sharp increase in property values. In some areas, residential properties are appreciating by as much as 15% annually, offering exceptional return potential for investors. This supply-demand imbalance creates a strong opportunity for foreign investors seeking long-term capital growth and rental profitability. Beyond the lifestyle appeal, the numbers make sense: long-term value appreciation, consistent rental income, and legal instruments like non-payment insurance make real estate in Spain a secure and profitable asset.

At LPB Solicitors, we not only identify high-return opportunities but also manage your investment end-to-end—from legal due diligence to rental contracts and tax efficiency.

Access to Opportunities Outside the Market

Thanks to our collaboration with banks, vulture funds, and foreign investment platforms, we offer high-profit, low-visibility properties not listed online. These are vetted assets with strong capital growth or rental yield potential—ideal for serious investors seeking real value.

Request access to off-market investments with high potential returns

Related Services

Let us help you settle and thrive in Spain

Our Investment Advisory Services for Foreign Clients

Investment Strategy and Legal Structuring

We help you define a legally secure and tax-optimized structure for your real estate or financial investment in Spain.

Due Diligence and Risk Assessment

We conduct in-depth legal analysis of each asset or project before purchase, eliminating exposure to hidden liabilities.

Access to Off-Market Real Estate

We source high-return real estate assets through direct deals with banks, funds, and institutional sellers.

Tax and Wealth Planning for Investors

We advise on minimizing taxes such as capital gains, wealth tax, and income tax through proper structuring.

Power of Attorney and Remote Operations

We manage your investment legally and transparently, even if you reside abroad.

Rental Property Legal Management

For buy-to-let investors, we offer legal leasing services, tenant contracts, and rental tax compliance.

Company Formation for Investment Purposes

We help create SLs or holding structures to acquire and manage your Spanish investments efficiently.

Ongoing Legal and Fiscal Support

Our legal consultants support your long-term investment strategy, adapting to regulatory and market changes.

Gain a competitive edge in Spain’s property market with our legal and investment expertise

Secure High-Return Investments with Full Legal Protection

If you’re a foreign investor or non-resident looking for serious returns in Spain, LPB Solicitors is your legal and strategic partner. We connect you to exclusive, off-market assets, provide risk-controlled acquisition processes, and structure your investment for maximum legal and fiscal efficiency.

Schedule a confidential consultation and access investment opportunities with premium legal support

Investment Advisory in Spain

1. What types of investment opportunities do you offer to foreigners and non-residents in Spain?

At LPB Solicitors, we offer access to high-yield real estate investments and financial products such as funds, stocks, and bonds. Most of our property deals are off-market, sourced directly from banks, funds, and institutional sellers—not available on public portals. We help you select the right asset based on your goals and risk profile.

2. Why is legal and tax advice essential when investing in Spain as a foreigner?

Spain has specific legal and tax regulations for non-residents and foreign investors. Without proper guidance, you risk delays, over-taxation, or invalid contracts. Our English-speaking lawyers and legal consultants structure your investment to ensure compliance, optimize taxes, and protect your assets legally.

3. Can I invest in Spanish real estate without being physically present in Spain?

Yes. Through power of attorney, we manage the entire process remotely—acquisition, legal checks, notarial signatures, and registration. You stay informed while our legal team handles the procedures with full transparency and legal security.

4. What makes LPB Solicitors different from traditional real estate advisors?

We’re not agents—we are legal and investment consultants. We don’t just sell property; we assess the legal and tax impact of every deal. We work with a limited number of clients to offer exclusive attention and source off-market properties with the highest potential return.

5. Can you help me with both real estate and financial investments in Spain?

Absolutely. Whether you’re buying residential or commercial properties, or building a diversified financial portfolio, our team of investment consultants and legal experts will guide you. We analyze market trends, assess risk, and provide tax-optimized strategies tailored to your investment timeline.